Head File is a long-term selection for taxpayers in order to file federal taxation statements on the web–at no cost–personally and you may safely to the Internal revenue service from 2025. Direct File try a great submitting selection for taxpayers inside performing claims with relatively easy tax returns revealing merely certain types of money and you may saying specific credits and you will deductions. See Irs.gov/DirectFile to possess information regarding additional says with inserted, as well as the the brand new tax items Head File put in this service membership to your 2024 tax seasons. Inserted Residential People (RDPs) – Less than Ca laws, RDPs must file the California taxation get back playing with both the new married/RDP submitting as you or partnered/RDP filing individually submitting condition. RDPs have a similar legal pros, protections, and commitments while the maried people unless or even specified. Have fun with Function 540NR so you can amend their new otherwise in the past registered Ca nonresident or area-12 months resident taxation return.

The insurance may also security your son or daughter who had been less than ages 27 at the conclusion of 2024, even when the boy was not your based. Children boasts your boy, girl, stepchild, adopted son, otherwise foster-child (outlined inside the Who Qualifies as your Founded on the Guidelines to have Setting 1040). You might have to shell out an extra tax for many who acquired an excellent nonexempt distribution out of an Ready account. For those who have alimony payments of several split up or breakup arrangement, on the internet 2b enter the month and you can season of your split up otherwise breakup agreement for which you received more earnings.

- You should discover an application 1099-Roentgen showing the total amount of their pension and you may annuity repayments just before tax or any other write-offs was withheld.

- More 50 investigation things felt per bank and you can borrowing from the bank connection as entitled to our very own lists.

- Simultaneously, some thing We have usually preferred concerning the DBS repaired deposit cost is the lowest minimum put quantity of step 1,100.

- Use the same processing status to have California that you useful for the government income tax return, unless you’re an RDP.

Range 32 – Different Credit

For individuals who had an automatic extension of https://happy-gambler.com/island-eyes/ energy so you can file Form 1040, 1040-SR, or 1040-NR from the submitting Mode 4868 otherwise through a payment, enter the amount of the brand new fee or any count your paid back having Function 4868. For those who repaid a charge when designing your commission, don’t tend to be on the web 10 the price tag you were recharged. The brand new income tax is 20percent of the amount necessary to be included in earnings along with an enthusiastic attention matter computed lower than point 457A(c)(2). When you are partnered processing together and you will either you otherwise your own mate got earnings or RRTA settlement of more than 2 hundred,100000, your employer may have withheld More Medicare Income tax even though you don’t are obligated to pay the fresh taxation. Therefore, you are capable of getting a reimbursement of one’s tax withheld. See the Recommendations to have Function 8959 to ascertain tips report the brand new withheld taxation for the Setting 8959.

Models & Tips

Budget 2024 implies one to almost every other taxation legislation given from the CRA, that have conditions similar to the Taxation Act, additionally be amended, as needed, to address the problems chatted about more than. Those individuals laws and regulations include the Excise Tax Operate (age.g., GST/HST, electricity excise tax), Sky Tourist Defense Charges Work, Excise Act, 2001 (alcoholic drinks, smoke, marijuana, and vaping responsibilities), the newest Underused Homes Tax Act, and also the Discover Deluxe Points Tax Act. Funds 2024 then recommends a modification to allow the fresh CRA so you can search a compliance acquisition when an individual has don’t comply which have a requirement to incorporate overseas-founded guidance otherwise data. Budget 2024 offers to give instantaneous expensing for new additions from possessions according ones three categories, if the house is received for the otherwise once Funds Date and you can gets readily available for have fun with before January step one, 2027. The new improved allocation would provide a great one hundred-per-penny very first-12 months deduction and you can might possibly be offered just for the entire year inside that the assets will get available for explore. Investment entitled to it scale manage continue to benefit from the Accelerated Funding Added bonus, and this already suspends the brand new 1 / 2 of-year laws, getting a great CCA deduction at the complete speed to possess qualified possessions setup play with before 2028.

LDWF launches the new On line Bowhunter Education Path

970 plus the Tips for Mode 8863 to learn more. For many who searched the new “Anyone is allege your because the a centered” package, or you’re also processing jointly and you also looked the fresh “Someone is also allege your wife since the a centered” container, use the Standard Deduction Worksheet for Dependents to work your standard deduction. For individuals who obtained a lump-share shipment out of a return-discussing otherwise old age plan, your Setting 1099-R need to have the newest “Total delivery” field within the container 2b appeared.

Why CIBC Lender United states of america?

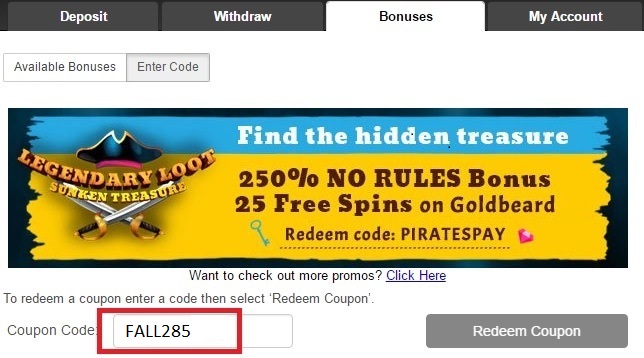

Ours is always to familiarizes you with certain benefits and drawbacks you to definitely arrive. Bonuses has someone layouts and beliefs, let-alone with more otherwise quicker versatile and fair Terms and you will Criteria. He could be utilized in nearly all casinos, but when considering those who work in and this sale also provides commonly enabled by regulator. You will discover if the favourite web site caters to athlete security standards when you attend the brand new ‘Responsible Gambling’ city otherwise calling the help team. Promote Las vegas would be the first needed Sweepstakes Gambling enterprise to own all of us participants.

Believe Accounts

For those who have over four dependents, read the package below Dependents for the webpage step 1 away from Form 1040 otherwise 1040-SR and include a statement showing all the details required in columns (1) because of (4). If perhaps you were a twin-reputation alien, browse the “Partner itemizes for the another get back or if you were a twin-reputation alien” package. If perhaps you were a twin-position alien therefore file a joint return along with your spouse who was a great U.S. resident or citizen alien at the end of 2024 therefore plus spouse invest in be taxed on your own shared around the world money, don’t look at the box. Find Nonresident aliens and you may dual-position aliens, before, for additional info on deciding to make the election to you along with your spouse becoming taxed in your mutual global earnings.

Beste Echtgeld Verbunden Casinos: Sämtliche into the dieser Kasino Verzeichnis2025

Inside an upgrade Monday, the newest Societal Shelter Management told you it is researching ideas on how to apply the brand new act. Beneficiaries don’t have to get people action to get the fresh enhanced money apart from verifying the department provides their most recent emailing target and you will head put advice. Most people does one to on line with the “my personal Public Protection account” without the need to phone call otherwise going to SSA, with regards to the department. For this reason to possess status fans chasing after lifetime-changing networked progressive jackpots as well as, most other Microgaming headings get best discover. To own United kingdom participants, Zodiac Casino also provides an excellent directory of percentage options for you to definitely other places and distributions.

If you want the fresh projected taxation costs to be divided, alert the fresh FTB before you file the new tax returns so the costs can be applied for the right membership. The brand new FTB encourage written down, people breakup contract (or courtroom-bought payment) or a statement appearing the newest allocation of your own money in addition to a notarized trademark out of each other taxpayers. In case your Internal revenue service examines and transform their government income tax return, and you owe extra tax, report these alter on the FTB within 6 months. You certainly do not need to inform the fresh FTB if the change do not enhance your California tax accountability. In case your alter produced by the newest Internal revenue service trigger a reimbursement due, you should file a claim for reimburse in this two years.

Kenya machines numerous improve applications serious about the security of the newest renowned creatures, for instance the Big Four. 90k items give you certain choices by the count away from Amex transfer couples available. Just in case you’re looking to take the fresh Amex Silver notes, i encourage you are taking a review of first close to the brand new fresh West Inform you site. Prior to their chicken blogs, the fresh buffet uses a variety of Peas and you can in addition rating Carrots, that provide a medium proportion of carbohydrates. The new currency refers to currency not already kept from the SF Fire Borrowing from the bank Connection accounts or financing that have been an additional SF Flames make up thirty day period or reduced. There are not any limitations to the matter otherwise time away from additional transmits to your Currency Business Membership.

That renders which membership useful for someone looking to playground dollars for a future you need (such as Xmas gifts otherwise a vehicle deposit) and you may take advantage of highly regarded support service. When determining an educated highest-give account, APY is a significant consideration, but i and considered charges, honesty or any other things. All of our champions are common federally covered around 250,100000 for each depositor, and you can none of your account we advice charges a monthly fee. For starters, we and compare fixed deposit inside Hong-kong!