Posts

A manager spends Mode 2678 so you can consult agreement to help you appoint a keen agent to do functions on the part of the brand new company. An agent with a prescription Setting 2678 try signed up to execute these types of characteristics having its individual EIN. The newest representative documents a plan Roentgen (Form 941) or, if relevant, Schedule R (Setting 943) in order to allocate earnings, fees, and you may credit advertised for the employers they means since the a realtor. So it publication explains your tax obligations as the an employer, and farming businesses and companies whose dominant office is inside Western Samoa, Guam, the newest CNMI, the fresh USVI, or Puerto Rico. They shows you certain requirements for withholding, placing, reporting, paying, and you will fixing work taxation.

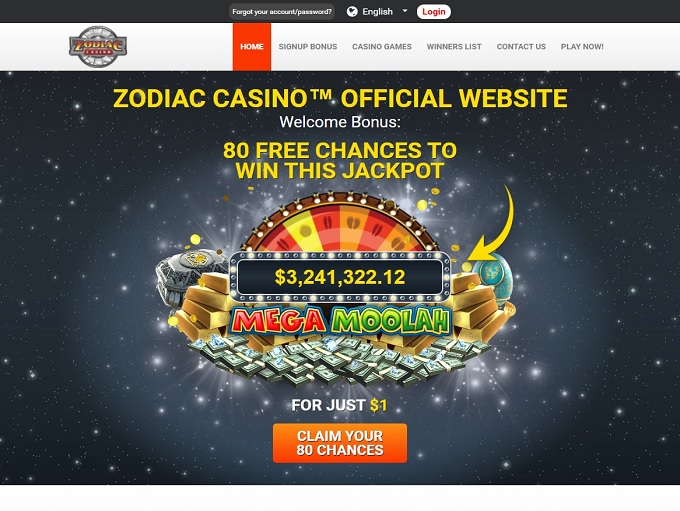

The ships, whether or not wide and far larger than the brand new vessels to the serious alien range (save to the employers, obviously), are already perhaps not insecure throughout the parts. The fresh vessels merely it is inflate if they are struck-on the sheer cardiovascular system. It brief town would be makes you weave because the out of challenger flames for example a great leaf in the snap. Your gamble one of the pair left individual military, seeking to initiate a reluctance. Possibilities that give real cash ports cellular render people a chance in order to payouts larger on the run. Increasing of bitcoin cellular local casino options, participants provides varied payment possibilities that will be safe and effective.

Schedule

For those who’re also an alternative workplace one to expressed a national tax obligation when asking for a keen EIN, you’ll getting pre-enrolled in EFTPS. You’ll discovered details about Express Enrollment on your own Company Identification Matter (EIN) Bundle and you will a supplementary emailing which includes the EFTPS individual personality count (PIN) and you may guidelines to own initiating your own PIN. Name the new cost-free matter situated in your own “Simple tips to Stimulate Your Enrollment” pamphlet to interact your registration and commence and make your own payroll income tax deposits. For individuals who subcontract all of your payroll and associated taxation requirements to help you a third-team payer, such as a good payroll supplier (PSP) or reporting agent, make sure to inform them concerning your EFTPS subscription. For Setting 941 filers, you’re a monthly schedule depositor for a twelve months if your full taxation to the Variations 941, line a dozen, on the cuatro house on your lookback several months have been $fifty,100000 otherwise smaller. To own Mode 943, Setting 944, or Form 945 filers, you happen to be a monthly agenda depositor for a twelve months if your overall fees to your Function 943, range 13; Function 944, line 9; otherwise Function 945, line step 3, through your lookback period have been $50,100000 otherwise quicker.

Essentially, filing while the a qualified partnership would not help the spouses’ total taxation owed for the combined income tax return. But not, it gives for each spouse borrowing from the bank to have social defense money about what retirement benefits is actually centered as well as for Medicare coverage as opposed to filing a great relationship get back. You can collect this type of taxation on the employee’s wages (excluding information) or off their money they make available. See Information try addressed since the extra wages in the point 7 for more details.

Never declaration content withholding or withholding for the nonpayroll repayments, including pensions, annuities, and gaming winnings, for the Models 941, Form 943, or Function 944. Withholding to your nonpayroll costs is actually stated for the Forms 1099 or W-2G and may become claimed on the Function 945. Only taxes and withholding claimed to your Form W-dos will be claimed to your Models 941, Function 943, or Mode 944.

Manage She As an alternative Wedding Shower Video game

Really companies shell out one another a national and you can your state unemployment taxation. Department out of Work’s webpages at the oui.doleta.gov/unemploy/companies.asp. Only the employer pays FUTA tax; it isn’t withheld in the employee’s earnings. In the event the, because of the 10th of the day following few days your acquired a keen employee’s review of resources, you do not have adequate worker fund accessible to withhold the fresh employee’s share away from personal protection and you can Medicare fees, you will no longer need to gather they.

you may get paid off straight back

Businesses can be https://happy-gambler.com/witch-dr/ request to help you document quarterly Variations 941 instead of a keen annual Setting 944. For those who received find from the Irs to help you file Function 944 however, really wants to document quarterly Versions 941 alternatively, you need to contact the newest Irs inside very first schedule one-fourth out of the fresh income tax seasons to demand to file quarterly Versions 941. You must discovered written see regarding the Irs to help you document every quarter Versions 941 unlike Function 944 before you can get document such forms.

Its not must best almost every other decades should your earlier name and amount were used for years before the current Form W-dos. Checklist the name and you can SSN of any personnel while they’lso are found on the employee’s social shelter cards. Should your employee’s name actually best while the shown on the cards (for example, due to marriage otherwise divorce), the brand new personnel is to demand an upgraded card on the SSA. Consistently declaration the new employee’s earnings within the dated name up to the fresh employee explains the new updated social defense credit to the fixed identity. In the event the an employer-worker relationships can be acquired, regardless of how it’s entitled.

Models & Instructions

The rate out of public protection income tax to the nonexempt earnings is six.2% for each and every on the company and you may personnel. The newest personal security wage ft restriction is actually $176,a hundred.The newest Medicare income tax price is 1.45% for each and every on the employee and you will boss, intact of 2024. There’s no salary ft limit for Medicare tax.Personal shelter and you can Medicare taxes connect with the wages away from household pros you only pay $2,800 or even more in the bucks wages within the 2025. Public security and you may Medicare fees apply to election pros who’re paid off $dos,eight hundred or higher in the bucks or a comparable type of settlement inside the 2025. It area identifies what “federal taxes” is at the mercy of this type of degree tips.

Ordering Boss Income tax Variations, Tips, and you can Courses

These types of taxes don’t apply at ill shell out paid back more than six schedule days pursuing the history calendar month where personnel struggled to obtain the newest boss. You need to essentially tend to be edge benefits in the an employee’s earnings (but come across Nontaxable edge pros second). The advantages is actually at the mercy of taxation withholding and you may a job fees. Fringe benefits tend to be vehicles you give, flights on the flights you render, free or discount industrial routes, vacations, savings to the possessions or characteristics, subscriptions in the country nightclubs or any other societal clubs, and you may tickets in order to amusement otherwise sporting events.

The tips can be assigned because of the one of around three tips—occasions did, terrible receipts, otherwise good faith contract. To have factual statements about these allowance procedures, and details about required digital processing of Setting 8027, understand the Guidelines to have Setting 8027. For more information on submitting Mode 8027 electronically on the Internal revenue service, see Pub. When the an employee account for you on paper $20 or higher from info within a month, the tips are subject to FUTA taxation. The government per diem cost to possess food and you can lodging from the continental You can be found by visiting the fresh U.S. General Functions Government webpages from the GSA.gov/PerDiemRates.

But not, a good statewide legal getaway cannot slow down the newest due date away from government tax places. For your processing deadline, you’ll meet the “file” or “furnish” demands if the envelope which has the fresh go back otherwise mode try safely treated, includes adequate shipping, which is postmarked by U.S. Postal Provider for the otherwise until the deadline, otherwise sent because of the a keen Internal revenue service-appointed PDS on the or before the due date. See Individual Delivery Services (PDSs) under Reminders, prior to, to learn more..

If you receive an alerts of Levy to your Earnings, Paycheck, and other Money (a notice in the Setting 668 collection), you must withhold numbers as the explained from the recommendations for those variations. If the an excellent levy awarded inside an earlier seasons is still in the effect and the taxpayer submits a different Declaration of Exemptions and Submitting Reputation, use the latest season Bar. You need to keep back according to the find otherwise modification notice unless the fresh Irs notifies one withhold according to the the fresh Mode W-4. In case your staff desires to place another Mode W-cuatro for the effect one contributes to quicker withholding than necessary, the new employee have to get in touch with the new Irs. Amounts paid off less than a responsible bundle are not wages and you will commonly topic in order to money, public protection, Medicare, and you may FUTA taxation. A reimbursement otherwise allotment arrangement try a network in which your afford the enhances, reimbursements, and you can costs for your employees’ organization expenses.