Someone thinking of buying the very first domestic usually have a broad a number of home loans to choose from. Our company is willing to promote several sort of first-time household visitors software which will match just about every potential you want.

Regulators Mortgage loans

The united states Authorities manages step three preferred lending organizations; FHA, Virtual assistant, and USDA. As an alternative, for each and every agencies features its own number of legislation and you can direction to own offering home financing. Loan providers are allowed to offer authorities money as long as

- He or she is authorized by the department getting financial credit

- They follow the advice set forth because of the per service

FHA Money

FHA is short for you to definitely means the fresh Federal Housing Expert. FHA financing have been around for a long time and generally are very popular among the first time household visitors audience. While using the an FHA financial, customers was expected to blow at least step three.5%* of your transformation price while the a downpayment. Exactly like most other fund, FHA allows the fresh new down-payment to-be something special of a member of the brand new borrower’s loved ones. It will be possible to utilize give funds from either regional otherwise state enterprises in almost any states.

Another determining fact regarding FHA is actually being able to accept loans having borrowers which have bad credit. You’ll be able to get approved for a home loan that have FHA whether your debtor features a credit rating lower with the 500spared with other apps, this option simple truth is a huge help multiple borrowers.

FHA also allow merchant of the home to expend brand new closing costs into financial. It is an excellent function to possess a first time house customer also it can cut the customer thousands of dollars in the the brand new closure.

Virtual assistant Funds

Virtual assistant is an acronym towards Experts Government. Just like the identity suggests, this type of financing are provided in order to qualifying people in new army. The newest Va keeps a list of certificates for all of us you to possibly offered definitely from the army or perhaps in often new reserves or Federal Guard. The loan officer can go more the solution some time and determine their qualification.

Among the many web sites of one’s Va financial program is actually this new zero down-payment selection for Veterans with enough entitlement. Getting qualified consumers, Va allows a mortgage to new home’s selling price otherwise appraised worthy of, whichever is lower.

A different major selling point is the fact there is absolutely no mortgage insurance rates to your Virtual assistant finance. Really mortgage software usually charge home loan insurance coverage so you’re able to consumers if they pay less than 20% off at the time of purchase. Although not, Virtual assistant does not have any such signal.

The fresh Va guidance personal loans in Louisiane having borrowing are also some flexible. Generally, the mortgage underwriter often familiarize yourself with the most recent 12 months away from credit score to the qualifying debtor to choose qualification. This might be specifically helpful whenever you are an initial time household customer.

USDA Outlying Homes Finance

USDA is an acronym for the You Institution of Farming. The newest USDA offers a home loan understood by many people labels instance Rural Financial, USDA Outlying Houses financial, or USDA loan. All of them relate to the same financing.

USDA lets licensed individuals to invest in within the home’s selling price and/or appraised really worth, whichever is lower. Consequently there is no significance of a downpayment.

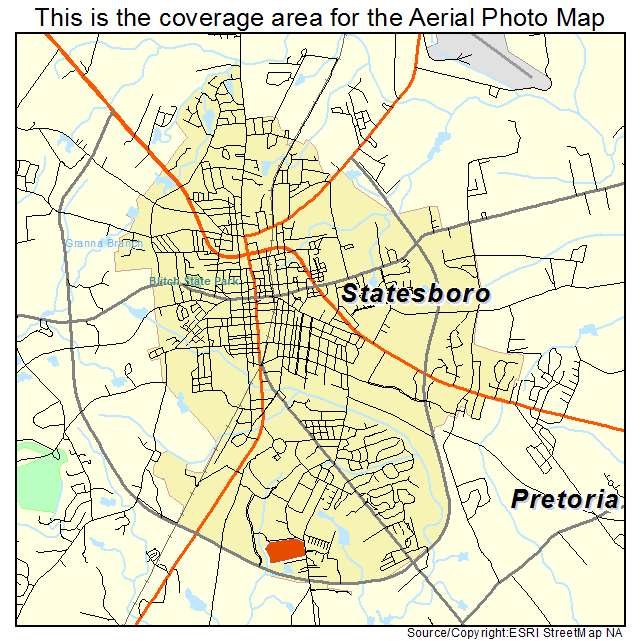

The primary pinpointing factor of the USDA financial are assets qualification. So you’re able to qualify for a good USDA mortgage, the home must be found in this a place believed outlying because of the USDA. But not, one term is a little misleading. A lot of the highest metropolitan areas in america in fact features rural elements appointed by the USDA within this a few miles of its downtown urban area. In reality, many claims enjoys whole counties that are also known as outlying by the brand new USDA.

Henüz yorum yapılmamış, sesinizi aşağıya ekleyin!