To be honest no-one with the same credit history usually shell out a whole lot more in making a much bigger down-payment, with no that with the same advance payment pays significantly more to possess that have a far greater credit rating. Those with good credit score may not be subsidizing those with tough credit scores.

The problem is that every people do not discover financial rates grids. What come just like the an unwell-told argument on the an extremely challenging financial policy is turned into a pessimistic way to draw homeownership for the community conflicts. It will not performs. Thus, let’s take a careful go through the info and you may define just what took place, what is actually being done, and you will what we want to do to ensure that everyone try treated fairly with respect to just how much they can cost you locate a home loan.

Last sunday, the latest Wall surface Street Diary had written a good scathing editorial alleging one a separate rule often increase home loan costs to have borrowers that have good credit so you can subsidize high-exposure borrowers

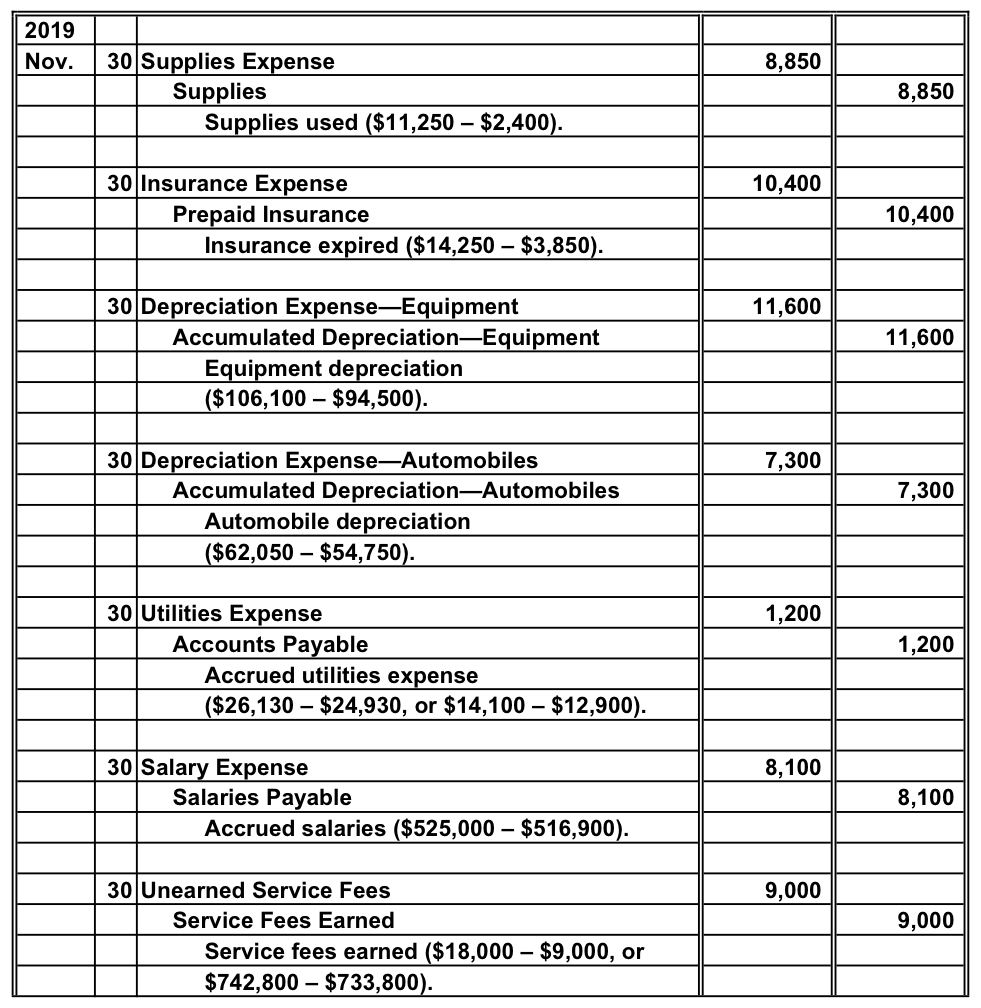

The brand new Log said one within the rule, and therefore goes in feeling Will get step 1, homebuyers with a good credit history more than 680 will pay from the $forty significantly more monthly into the a great $400,000 financing. Individuals who create off money out of 20% on their home pays the best charge. Those individuals costs is then accustomed subsidize large-risk borrowers because of down fees. Its end is this try an effective socialization from risk you to definitely flies facing every mental economic model, while you are guaranteeing housing industry breakdown and you can putting taxpayers vulnerable to highest default rates. It is not genuine. Brand new taxpayers aren’t any kind of time higher risk, and you can neither try homeowners, loan providers, or anyone site hyperlink else. The allegations check one aspect from an elaborate equation you to definitely charge significantly more for a lot of that have large downpayments that it should not however it is wiped out because of the the rest of formula.

The guy recommended this are an effort so you can push new GSEs to include most useful performance for very first-go out homeowners with all the way down [credit] results, lots of who might possibly be minority individuals, [as] might have been required by the civil-rights and consumer activists to own many years

Dave Stevens, an old president of one’s Mortgage Bankers Organization and you will FHA Administrator inside the Federal government had written regarding the the new pricing grids when you look at the an enthusiastic op-ed inside the Property Cord for the February six, a few months following the fresh grids were made public. Its very strong from the weeds, rather than the majority of people seen they (also me). This new GSEs is the Regulators-Paid Businesses Federal national mortgage association and you may Freddie Mac computer. New grids are Loan Top Rates Improvements (LLPAs) charged to your some GSE fund due to the fact an extra payment to guard facing borrowing from the bank chance usually covered by mortgage insurance policies, expected to your GSE finance which have down repayments less than 20%.

The situation try obtained by the Nyc Summary of April sixteen, to the headline The United states was subsidizing high-chance homeowners – at the expense of those with a good credit score. It failed to take very long having FOX Organization Reports to get the story a short while following, where Stevens told you he had merely obtained an email off an excellent financial just who told you, thus i guess we must show individuals to get worse the borrowing in advance of they sign up for financing. It is a creative speaking point. It just might completely wrong, however, best for about three reports shops belonging to Rupert Murdoch.

By the point brand new Wall Roadway Diary had written the article, the latest narrative is every where, plus Newsweek, Members of Congress to your both sides of your own aisle were consistently getting calls using their constituents who had been outraged. It got even worse to your CNBC when point Becky Short come the brand new interview of the stating consumers that have a good credit score score manage pay highest fees whenever you are riskier people gets more advantageous terminology. Stevens twofold down, saying that reduced-borrowing quality individuals is cross-paid from the individuals having large credit scores and better downpayments. Process Promise president and creator John Vow Bryant accurately said it is not from the credit ratings, that is correct, after which told you this new allegation was officially correct, which it is not. To your Monday, Casing Monetary Services President Patrick McHenry (R-N.C.) and you will Houses and Insurance rates Subcommittee President Warren Davidson (R-Ohio) wrote to help you FHFA Director Sandra Thompson, insisting one to she repeal the fresh new LLPA changes. The issue and emerged within a paying attention of your own Senate Banking, Housing and you may Urban Points Committee.

Just how performed they all get it thus wrong? As the risk-dependent pricing grids is actually ridiculously difficult, and also a home loan professional such as for example Stevens and you may a highly recognized creator like Short is also misread all of them, perhaps you have realized in the chart less than. The fresh purple packets is LLPAs that are straight down for people with lower down costs as opposed to those energized for individuals who lay a whole lot more than simply 20% down with the exact same credit rating. I agree with Stevens this particular factor is not reasonable, but it is nonetheless a moment charges, since the column to the right makes clear. This proves the most significant prices differential between your >20% down costs together with

Henüz yorum yapılmamış, sesinizi aşağıya ekleyin!