With respect to investment your perfect house, knowing the credit requirements is crucial. Within part, we’re going to diving to the researching Virtual assistant financing credit standards with other models off financing.

Some lenders generally speaking render just conventional funds and require the absolute minimum credit history anywhere between 620 to 680. It is a giant disease getting pros and you may army participants just who you should never satisfy rigorous criteria getting typical fund.

FHA money, likewise, convey more lenient credit rating standards however need to pay month-to-month financial insurance. There’s no monthly financial insurance coverage toward Virtual assistant funds so a Virtual assistant financing is close to usually a much better option than FHA.

As to why Choose Virtual assistant Fund Just after Bankruptcy?

If you had a chapter 7 case of bankruptcy, you can buy a special Va mortgage merely 2 years after its discharged. You’ll need to provide a complete need from as to why new bankruptcy happened and show which you now have monetary stability.

In some instances, you can purchase a beneficial Va mortgage shortly after a section eight case of bankruptcy launch 1 year ago. The cause of the brand new bankruptcy should determine whether or not it should be you can. If you can demonstrate that your own Part thirteen bankruptcy is triggered of the extenuating factors away from control, upcoming certain Virtual assistant lenders can get approve you to own good Va loan regardless of if your own Chapter 7 bankruptcy proceeding is released 1 year ago.

HomePromise provides aided pros be eligible for a Virtual assistant mortgage 1 year immediately after discharge of a chapter 7 case of bankruptcy. Phone call 800-720-0250 to see if you be considered.

If for example the bankruptcy proceeding was a section 13 instance, you will need to render a complete cause on paper of one’s items of bankruptcy identical to a chapter seven. But, you don’t have to waiting 24 months on the time from www.availableloan.net/installment-loans-mo the release.

In fact, there’s no waiting period once launch to possess a chapter 13 case of bankruptcy. To locate good Va mortgage after the Part thirteen case of bankruptcy, other variables should be taken into consideration. One items is the examination of your payment history regarding bankruptcy proceeding plan.

The guidelines and you will guidance for Chapter thirteen bankruptcies will likely be challenging. Name 800-720-0250 to learn more and to find out if you meet the requirements.

Traditional fund has more strict rules. Such laws and regulations wanted a delay out of number of years immediately after A bankruptcy proceeding personal bankruptcy discharge. Concurrently, they need a delay away from 24 months after Chapter thirteen personal bankruptcy release.

How will you Alter your Credit score for a good Va Financing?

Adjust your credit score to own an effective Va mortgage, there are lots of things to do. Earliest, make sure to pay-all of debts timely. Later repayments might have a negative effect on your credit rating. Create automated money or reminders to stick to tune.

Lower any higher-focus expenses first and get away from trying out brand new loans whenever possible. Keep the personal credit card debt profile below fifty% of your own limitation that one may charges into the credit card.

A different way to boost your credit score is via staying dated accounts unlock as well as in a updates. Your credit score was dependent on the length of their credit record. It’s always best to continue old levels open, no matter if these have already been paid down.

In addition, continuously examining your credit report to have problems is extremely important. Mistakes happen, and you may incorrect advice is lower your get needlessly. Conflict any inaccuracies towards related borrowing from the bank agency.

Show patience while the boosting your borrowing from the bank will take time. Doing a good monetary habits commonly slowly raise the score, expanding our very own probability of getting good Virtual assistant loan.

How will you Sign up for a Virtual assistant Financing?

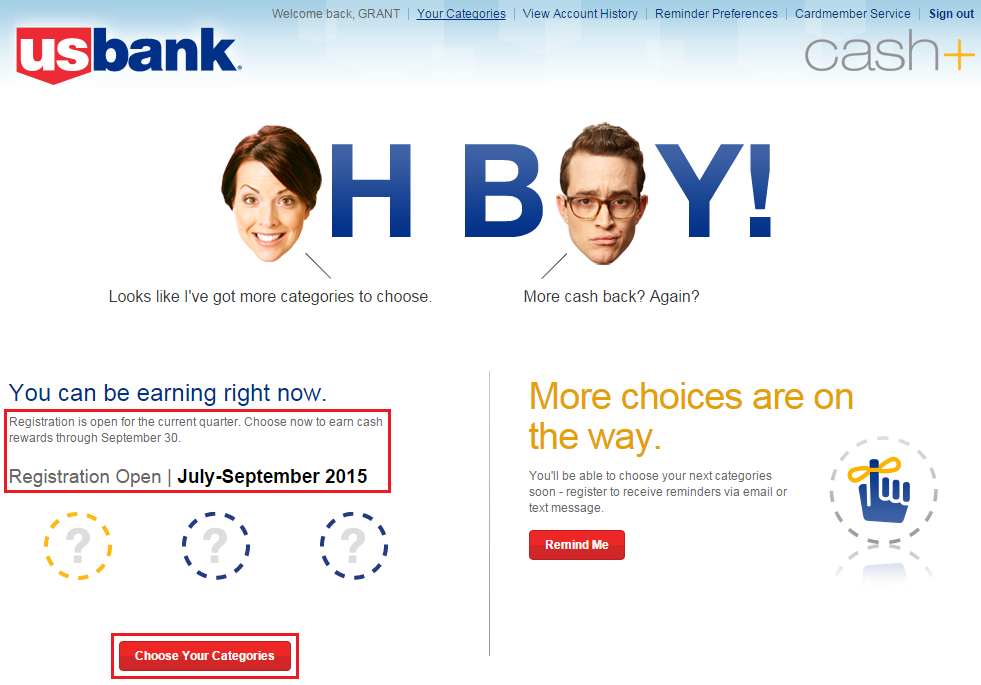

![]()

Using that have HomePromise try a hassle-100 % free procedure that assures pros and their family can acquire brand new family of their desires. With HomePromise’s effortless on the web software, you can rapidly navigate from the application process from the comfort of the home.

Henüz yorum yapılmamış, sesinizi aşağıya ekleyin!